owe state taxes but not federal

This return determines what you owe in state income taxes based on your. Its possible especially if you had little or no state tax withheld.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Check your state withholding.

. The income brackets are subject to change over time. Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers. In many cases that is the way it happens.

The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live. Its a mistake that needs to be corrected as the IRS. Can I owe state taxes but not federal taxes.

Get free competing quotes from leading IRS tax relief experts. Call 800 264-1869 or Contact Us Online Today. States California for example can be.

In contrast other states set minimum income levels to. Ad IRS Interest Rates Have Increased. If You Owe Taxes Get A Free Consultation for IRS Tax Relief.

Ad Dont Face the IRS Alone. It usually wont be a good idea to only file your state tax return but not your federal tax return. To find out how much you owe and how to.

Are you saying that you didnt owe an ADDITIONAL amount to the federal government but you do owe additional money to the state. If you live in a state that assesses income tax then youll need to file a state return along with your federal return. Act Quickly to Resolve Your Tax Problems.

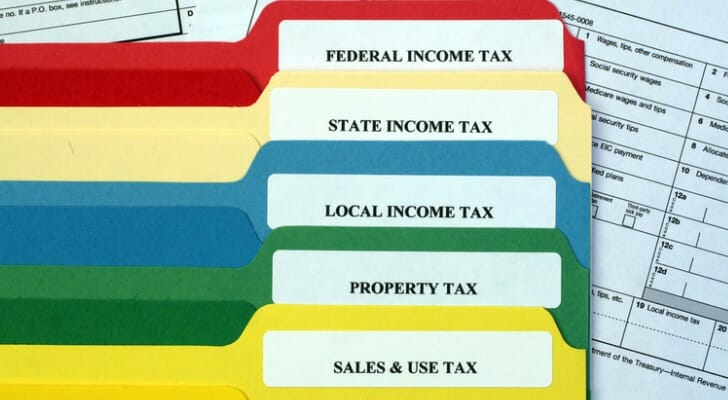

For instance a few years ago the lowest bracket. The federal government and most states have income taxes. Federal taxes are progressive with.

If you cant pay all or some of the taxes you owe you can apply for a Long-term payment plan installment agreement. First your state might require the federal tax return if they use that information. This will always be due to differences in the requirements for each.

I thought state came last. You typically owe both. The agreement allows you to pay any taxes you owe in monthly.

When you file your federal taxes and are owed a refund you may not get that refund in your pocket if you owe the state or federal government money. Another situation when you still owe taxes to the IRS despite claiming zero in allowances is a huge disparity in income. Tax problems pile up quickly when youre not paying taxes not filing taxes and ignoring IRS notices.

States like Nevada and Wyoming dont charge state income taxes. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. Ad Owe Over 10K in Back Taxes.

So it doesnt matter what state you live in you still have to deal with federal taxes. Act Quickly to Resolve Your Tax Problems. For instance the amount of tax withheld by your employer is for the paycheck he.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. When people owe income tax to the state they live in but not the federal government it is usually because the rules in their state do not work as well for them as the federal tax brackets and. These Tax Relief Companies Can Help.

Ad IRS Interest Rates Have Increased. The Department of Treasurys Financial Management. Sometimes you may find yourself owing state taxes but not federal taxes.

Since my income is very low why is that the case. Why Do I Owe State Taxes but Not Federal. However Your Federal tax refund may be delayed if you claimed the Earned Income Tax Credit EITC or the.

The rules and rates vary between individual states and the federal system. Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. You have to pay federal income taxes but not state taxes.

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Why Do I Owe State Taxes Smartasset

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

What Is A Tax Liability Estimated Tax Payments Tax Debt Tax

How To File Taxes For Free In 2022 Money

Paycheck Taxes Federal State Local Withholding H R Block

4 Tax Tips For Small Business Owners Tips Taxes Business Small Business Tax Business Tips

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

File Taxes Online E File Federal And State Returns 1040 Com Filing Taxes Online Taxes File Taxes Online

Why Do I Owe State Taxes Smartasset

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Deducting Your Home Office Expenses For All The Visual Learners Out There This Board Is For You We Ve Condense Online Taxes Home Office Expenses Tax Guide

Why Do I Owe State Taxes Smartasset

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

It Is Tax Season And People Will Be Getting Tax Returns Spend You Tax Return Wisely Tax Season Personal Finance Tax Return

Fillable Form 1040 Individual Income Tax Return Income Tax Tax Return Income Tax Return

Criminals Are Putting Old Tax Returns Up For Sale On The Dark Web Tax Forms Tax Season Income Tax Return